Internet Acquiring

Streamline Payments Easily

Explore our seamless API endpoint for swift and secure transactions by external providers and banks, supporting various transaction types.

Payment Page

External withdrawals or transfers are made using previously saved credentials. For security purposes, they have 2FA functionality. Each request is displayed in the core/manage system for analysis by the manager.

Personal Back Office

The personal back office for each merchant displays a list of transactions with detailed data, a list of payments and refunds, statistics for each currency, as well as functionality for subaccounts and roles.

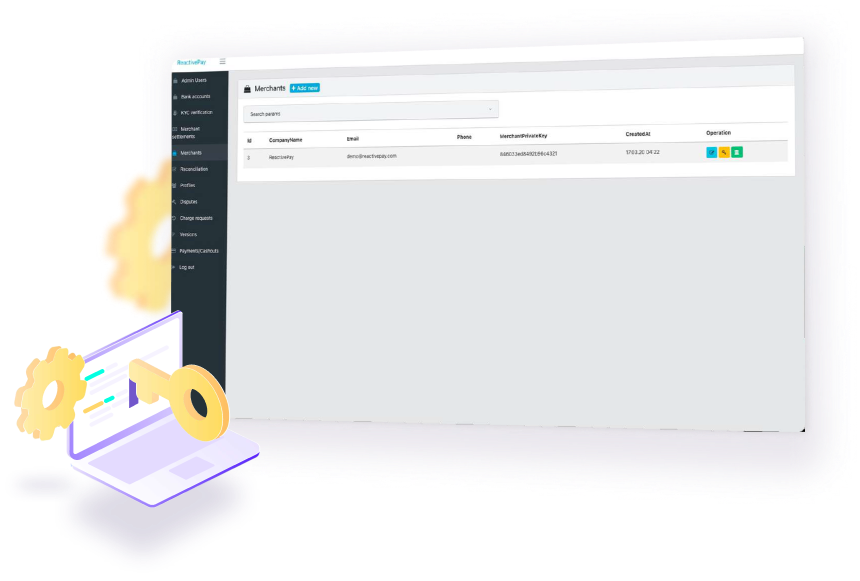

Management and Administration

We offer various access rights, as well as extensive opportunities for effective management of merchant profiles. It also includes functions for dispute resolution, banking applications and KYC verification.

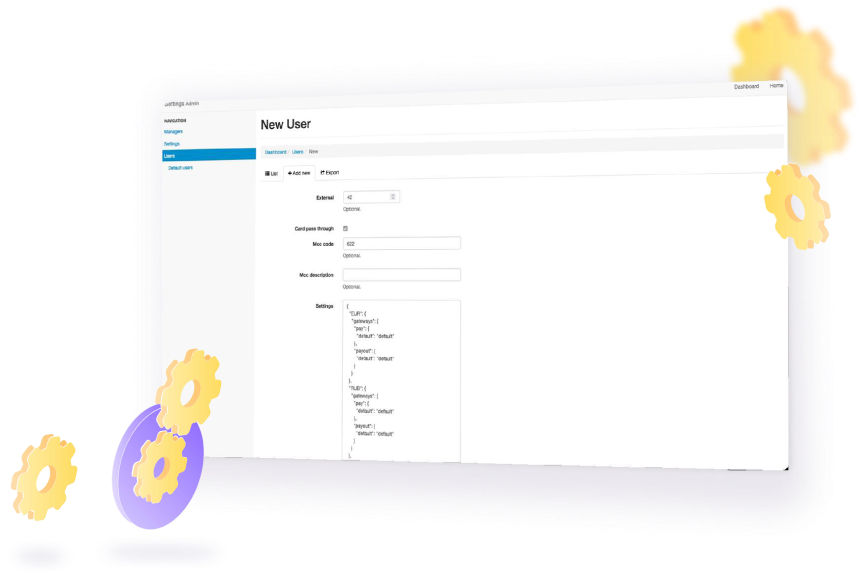

Settings

Easy setup of interaction with providers and banks. Our JSON editor simplifies parameter editing, and aliases support multiple terminals for different currencies. Enjoy routing options and conversion settings

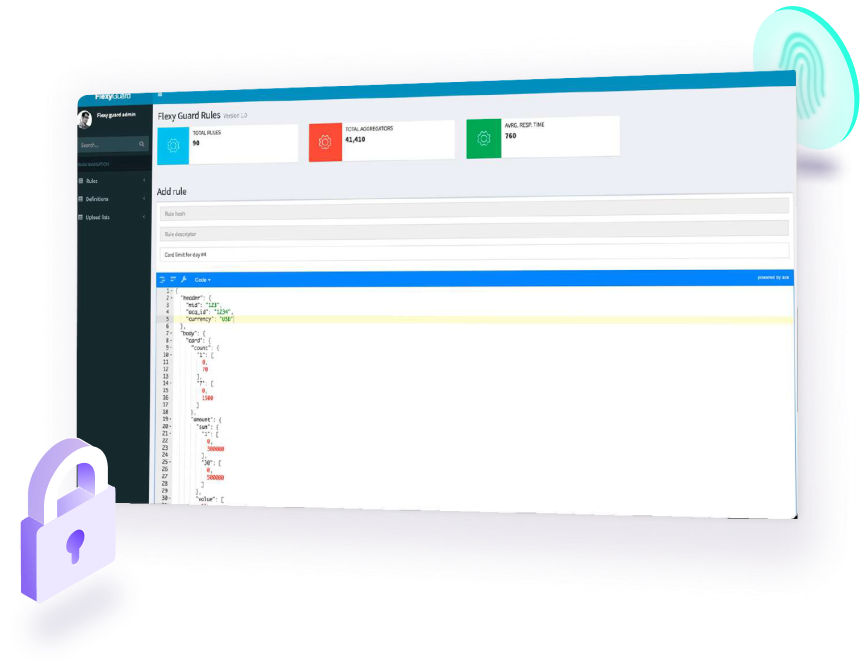

Guard (Security) System

Our proprietary anti-fraud system provides reliable control over incoming traffic. Create rules of varying complexity to limit parameters such as amount, product, email, and more.

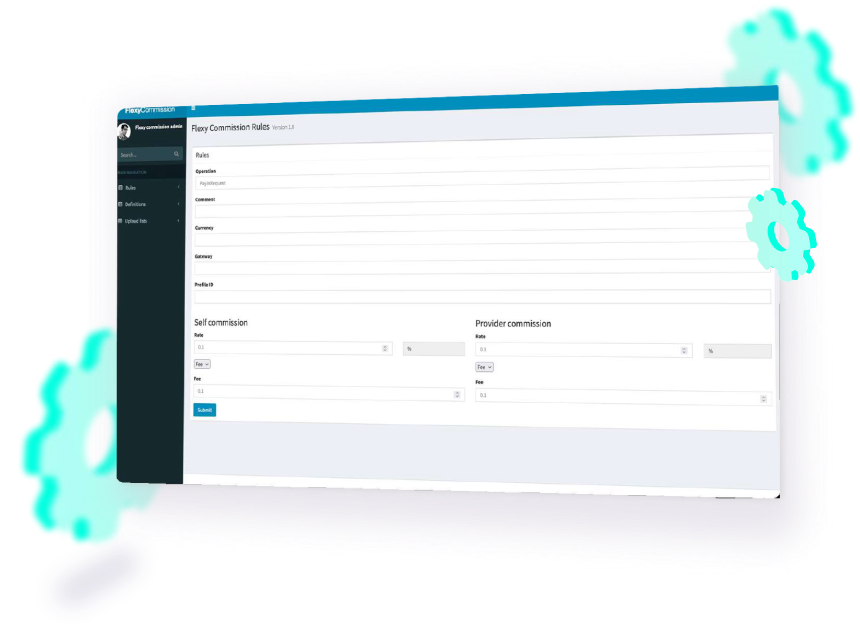

Commission System

Easily establish personalized, general or hybrid commission rules. Set minimum and maximum thresholds, fees and rates both for your own and provider’s commissions. Our handy template creation tool makes it easier to create commissions.

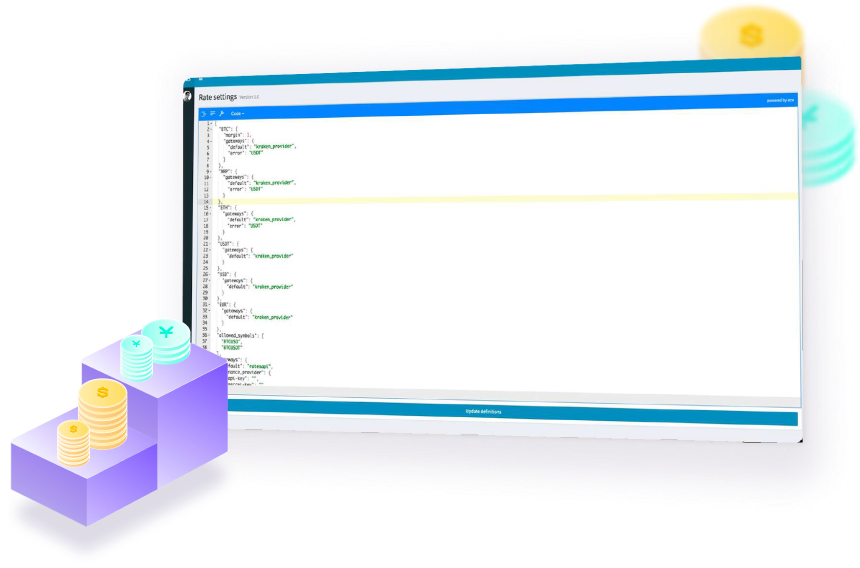

Adjusting Settings for Rate Providers

We make it easier to connect to rate providers by allowing you to customize rates for different currencies according to your preferences.

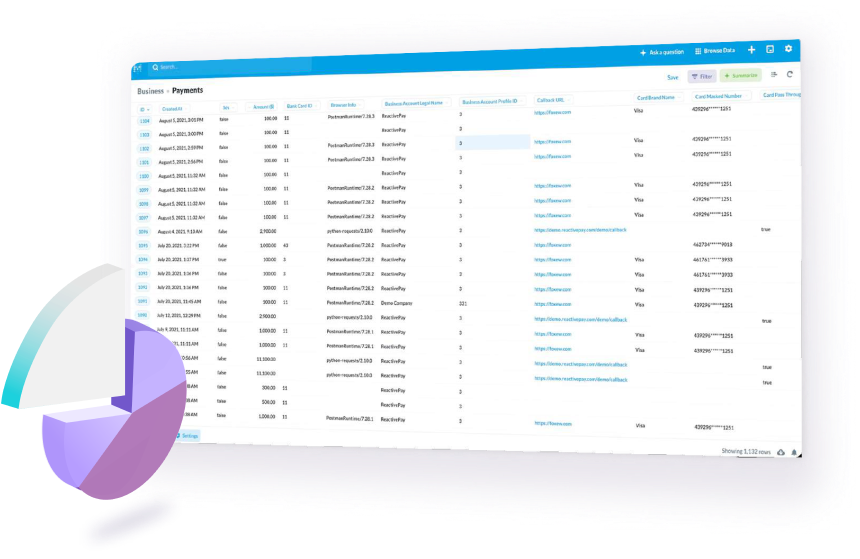

Metabase

A powerful system for data analysis. The databases of each project are connected to Metabase, which allows you to analyze and view complete information on all types of transactions, profiles, and any table in the system.